[Tmdl.edu.vn] Here’s a quick guide to calculating the budget and the EMI for purchasing a home, based on one’s earning capacity and the steps you need to take in advance, to meet this financial commitment

For most people, a house is a one-time purchase. Consequently, buyers often tend to overstretch themselves financially, to invest in the best property they can buy. Considering that investing in a house, is perhaps the single biggest financial commitment that most people make during their lifetime, it is important to use objective criteria, to decide how much you can afford.

var adpushup = window.adpushup = window.adpushup || {};

adpushup.que = adpushup.que || [];

adpushup.que.push(function() {

adpushup.triggerAd(“4cbc6643-b533-4344-bc4b-1c337dc43234”);

});

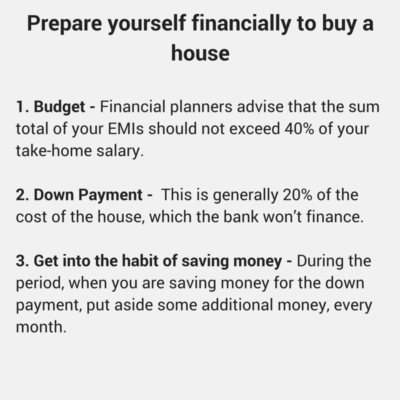

Budget

Financial planners advise that the sum total of your EMIs should not exceed 40% of your take-home salary. Thus, if your take-home salary is Rs 1 lakh, your EMI should ideally, not exceed Rs 40,000 each month. If you have other loans, then the EMI that you can pay on your home loan, gets whittled down further.

Now, imagine that Rs 40,000 is the EMI that you can pay, on your home loan. If the interest rate is 9.75% and you take a loan for 15 years, the maximum amount that you can borrow, is Rs 38 lakhs (source: emicalculator.net). Supposing that the bank will only give you a loan for 80% of the value of the property and 20% must come out of your own pocket, then, you can at best, buy a property worth around Rs 47 lakhs.

If you wish to increase the loan amount, you can club your spouse’s income with yours and borrow more. However, this option has a pitfall. Whenever you decide to start a family, you may go from being a double-income to a single-income family and the inflow of money into your household will dip.

[Tmdl.edu.vn] Financial checklist for buying a house

Ensure that there is enough money left, through the tenure of the loan, after paying your EMI, to meet your daily expenditures and also for some other needs, such as entertainment, education, etc.

You also need to consider job-related uncertainties. “Create a contingency fund, so that you don’t have difficulty in paying your EMIs, even if you are without a job for some time,” advises Prasunjit Mukherjee, head of Kolkata-based financial services firm, Plexus Management.

Down payment

You will also have to systematically save money to make the down payment on the house. This is generally 20% of the cost of the house, which the bank won’t finance. If you intend to purchase a house within the next three years, stick to low-risk instruments, such as fixed deposits and fixed maturity plans (FMP). If you have five to seven years before you plan to purchase a house, conservative investors can opt for monthly income plans (MIPs) of mutual funds. Those who have some appetite for risk, may invest in balanced funds, or even equity funds.

Get into the habit of saving money

During the period, when you are saving money for the down payment, put aside some additional money, every month. This will give you a rough idea of how much you can afford to spend on the EMI, without stretching your budget excessively.

Finally, remember that one needs to be flexible, when buying a house. “Education and retirement are goals that cannot be compromised upon. However, in case of buying a house, a goal of five years can easily be extended to seven, without doing any damage in most cases,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors. If you had invested in an equity fund or even in a balanced fund, for making the down payment and the equity market is faring poorly, you can defer your purchase by a year or two.

Source: https://tmdl.edu.vn/us

Copyright belongs to: Tmdl.edu.vn